Please gamble responsibly. If you or someone you know has a gambling problem, please visit gambleaware.com, gamcare.org.uk or gamstop.co.uk to find help.

Updated February 2026

Zero-risk betting cuts outcome exposure through hedging plus strict process, not guaranteed profit. Follow best zero risk betting strategy by combining matched offers, arbitrage, plus lay hedging on exchanges. Build safety layers: read terms, confirm eligible markets, record each wager, apply fixed stakes, keep withdrawals routine. Track offers in a simple sheet with date, odds, stake, return, notes.

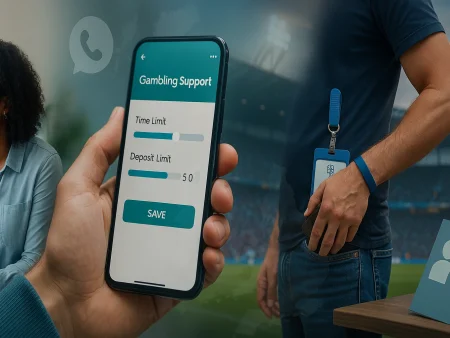

Stay within UK law, follow operator rules, avoid multi-accounting, keep play consistent. Respect ethical boundaries, refuse promo abuse, accept account limits, stop chasing stakes. Set deposit caps, loss stops, session timers. Pause after wins or setbacks. Let numbers drive choices, not emotion.

What Is a Zero‑Risk Betting Strategy & Why It Works

Bookmaker promos pay you for volume. Price gaps add edge when a line lags behind the market. A betting exchange lets you lay the same outcome and smooth the return.

A zero risk betting strategy reduces outcome swings, then controls errors each time.

Outcome risk comes from the scoreline. Rules risk sits in terms, stake caps, voids, and settlement rules. Execution risk stems from odds moves, unmatched lays, and wrong clicks. This guide trims outcome risk by pairing back and lay positions. It trims rules risk by screening markets before staking. It trims execution risk through a tracker, placement timing, and sizing. Next, the methods section shows where each tool fits.

Experts Opinions:

Matched betting is nothing like that…a simple system where the profit is totally risk and tax free.

Sam Priestley, matched betting expert

Definition & Key Betting Terminology

| Back | Wager placed with bookmaker on an outcome |

| Lay | Counter‑bet against that outcome on an exchange |

| Odds | Numerical expression of probability |

| Liability | Amount risked if lay bet loses |

| Exchange | Platform where users bet against each other |

| Arb | Arbitrage bet covering every possible result |

How Back‑Lay Mechanics Remove Risk

Even precision strategies face tiny residual exposure from odd shifts, voided bets or overlooked terms, so ‘zero’ often means negligible. It’s vital for bettors to recognise best betting strategy truly means minimised rather than eliminated risk.

Experts Opinions:

It’s not always a bad idea to take a negative expected value bet if you’re into hedging and maximising bankroll growth.

Joseph Buchdahl, sports betting author and analyst

Definition & Key Betting Terminology

Use this glossary to cut betting risk during exchange work in the UK, where prices use decimals and exchanges charge commission.

- Back: bet for an outcome. Example: Back City at 1.80.

- Lay: bet against an outcome. Example: Lay City at 1.82.

- Odds: decimal price of a bet. Example: Odds 4.00 returns £4 per £1.

- Stake: money you place. Example: Stake £25 on a match.

- Liability: amount you lose on a lay win. Example: Liability rises at short odds.

- Commission: exchange fee on net wins. Example: Commission 2% trims profit.

- Free bet: promo stake with rules. Example: Free bet £10 on 6.00.

- Refund: stake returned after a loss. Example: Refund arrives as cash or token.

- Qualifying bet: stake used to trigger an offer. Example: Qualifying bet £10 at 1.50.

- EV: expected value of a wager. Example: EV turns positive via promos.

- Bankroll: funds set aside for this system. Example: Bankroll £300 supports stakes.

- Exchange: market matching backers with layers. Example: Exchange liquidity affects fill.

Keep these terms fixed so later steps stay clean. Record stake, lay amount, and liability before clicking confirm. Check commission rate, note settlement time, store screenshots for disputes.

How Back-Lay Mechanics Remove Risk

Use a risk free bet strategy by placing two opposing bets on one runner. Back the selection at a bookmaker for £20 at 3.00. Open an exchange market and lay the same runner at 3.05 for the lay stake shown by your calculator. If the runner wins, the back bet pays, the lay loses. If the runner loses, the back fails, the lay wins. Commission reduces exchange returns, so allow for the fee. Rounding creates pence gaps on small stakes. Partial matching leaves exposure, so confirm liquidity before placing, then refresh prices.

Understanding Residual Exposure of Zero vs Low Risk

Think of a low risk betting strategy as theory meeting real markets. Perfect balance exists on paper. Live play faces voids, max stakes, odds drift, thin liquidity, slow settlement, and human slips. Any one issue breaks the hedge. Avoid early kick off markets with suspensions. Verify correct market type and confirm both bets show as matched.

Accept small, planned losses on qualifying bets. A £0.40 loss to unlock a £10 free bet often leaves profit after hedging. Treat the qualifier as a fee for access, then return to strict sizing and checks.

Core Zero-Risk Methods

Treat online betting strategies as repeatable routines, not weekend tips. Offer matching turns promotions into cashable value through exchange hedges. Arbitrage captures pricing gaps across firms during slow updates or promos. Lay trading limits downside by setting liability first, then balancing returns. Supporting sections drill terms screening, careful records, fixed stakes, and emotion control, so slips stay rare. Use timers, entry checks, plus a pre trade checklist before each confirm.

Offer matching workflow

Run no risk matched betting uk as repeatable loop. Start with promo terms, place qualifying wager near 2.00 decimal to minimise qualifier loss. After settlement, claim free bet or refund credit. Open exchange market, lay same runner, set liability first, confirm full match, then record stake, lay amount, commission rate, net outcome, plus screenshots. Qualifying Bets Without Loss: target tight spreads, deep liquidity, late start times, plus simple win markets. Extracting Free-Bet Value: check token type, stake returned rule, odds cap, excluded leagues, plus best price search. Read every term before staking, focus minimum odds, bet type, if cash out voids reward, plus withdrawal path. Keep bankroll separate, use fixed unit size, avoid distractions, verify market name, record time stamps, store reference numbers.

| Step | Aim | Usual cost | Likely result |

|---|---|---|---|

| Promo scan | Find eligible offer | Time | Clean plan |

| Qualifier | Trigger bonus | Small loss | Token issued |

| Claim | Secure credit | None | Free bet |

| Hedge | Level outcomes | Commission | Stable return |

| Settle | Confirm credits | Delay | Funds released |

| Log | Track totals | Minutes | Audit trail |

Arbitrage surebet workflow

Use risk free betting strategies when two firms disagree on price. Gaps appear after promo uplifts, slow traders, or news. Place opposing positions across outcomes, so each result returns near equal cash. Work fast, stay precise, keep records. Limits, voids, and rule clashes turn small edge into loss. Keep timestamps, store slips, screen markets for settlement quirks, plus suspend risk. Calculating Balanced Stake Splits: balance returns across outcomes, allow rounding, include exchange commission, abandon trade after slippage, suspension, or sparse liquidity. Use two tabs, pre type stakes, confirm currency, verify selection names, place both sides within seconds, then audit fills before closing markets.

| Check item | What to confirm | Red flag |

|---|---|---|

| Market type | Same event, identical rules | Different settlement |

| Price time | Quotes still live | Line moved |

| Stake cap | Enough room for split | Max hit |

| Void rules | Refund treatment matches | One side voids |

| Liquidity | Full match possible | Thin book |

| Commission | Fee built into split | Rate unknown |

| Delay | Settlement pace acceptable | Long hold |

Lay trading fundamentals

No risk betting relies on exchange laying with tight control. A lay bet takes another punter’s stake and creates liability if selection lands. Start from maximum exposure, then derive lay size. During matched promotions, exchange hedge steadies returns when bookmaker side hits. Outside promos, laying supports trading by capping swing, yet downside remains. Use unit sizing, set daily ceiling, keep spare cash for margin calls. Avoid thin markets where partial matching leaves open positions. Check commission rate before entry, since fee reduces net win. Use limit orders near best price, avoid chasing drift. Review market name, selection, odds, stake, liability. Careless laying creates large exposure within seconds. When hedging, place exchange side first during fast markets, then book ticket within same price window. Keep unmatched exposure small, cancel stale orders, refresh ladder view, then re enter at new price.

Courtside loophole context

Zero risk approach fails with venue edge. Courtsiding means using live sight or stadium data before delay feeds reach bookmakers. Firms treat that practice as rule breach, then void bets, close accounts, or block withdrawals. Events add stewards, ID checks, plus device controls. Exchange hedges do not fix this risk, since voids strike one side only. Ethics also matter, since advantage comes from access others lack. Skip this route if you want stable promo conversion, clean records, plus long term account access. Most readers gain more from process, not loopholes.

Tipster platform checks

Sports betting advice risk stays high with tipsters, since tips do not hedge outcomes. Verification cuts uncertainty. Look for public proofing, long sample size, and realistic yield after fees. Check price model, staking rules, market type, and timing, since late posts miss value. Require method notes, injury handling, and disclosure on freebies or affiliate ties. Ignore guaranteed profit claims, since cherry picked records hide drawdowns. Pay only when tracking shows edge across hundreds of selections. Cross check results against closing line, then compare strike rate with market implied chance today.

Statistics data sources

Strategic betting improves when you lean on databases, not stories. Track form, injuries, minutes load, xG, shot quality, tempo, set piece rates, travel, surface, plus weather impact. Convert stats into price view. Start with implied probability from odds, then adjust using your data. Write estimate range, not single point. Bet only when price offers margin after commission and overround. Small samples mislead, so wait for stable trend, then review every position after settlement. Use season splits, home away, opponent strength, plus recency weights, so ratings react without overfitting too fast.

Price comparison sites

Odds comparison tools start this workflow. Comparison services show best line across firms, which cuts margin drag and spots misprices fast. Use them to find stale prices after team news, then act before market snaps back. Check line movement history, since steam often signals sharp money. Before staking, confirm exchange liquidity for hedge, plus ensure market not suspended. Small edges vanish if you chase drift or accept poor fill, so pre set target prices. Open bookmaker terms page too, since some lines exclude cash out credits sometimes.

Unit sizing rules

Low risk betting tips start with staking framework, not selection hunches. Use one unit size tied to bankroll, then cap exposure per day. Chasing systems raise stakes after losses and blow up discipline, since variance clusters. Set maximum daily liability across exchange positions, plus stop placing new bets once limit hits. Separate test bankroll from main funds, then trial any new market with tiny units for one month. Log every stake, liability, plus outcome, then review totals each week. Keep deposit methods slow, so impulse reloads do not break caps.

Specialise in one sport

Low risk sports betting improves with specialisation. One sport teaches schedule quirks, injury impact, pace shifts, referee trends, plus market behaviour. Focus reduces misclicks, wrong markets, and late news shocks. Keep simple habit: write pre bet note with price, reason, and expected range. After settlement, add post bet line on movement, surprises, missed info, plus any process slip. Review notes weekly, then adjust filters, league list, and timing. Over time, edge comes from fewer errors and sharper pricing sense. Pick one league set, watch matches, follow pressers, track line closes.

Reset plan for a big loss

Safe betting needs reset after heavy hit. Pause for twenty four hours, then audit process before placing again. Write stop limit in advance, then set deposit cap and session timer inside account tools before resuming. Share plan with friend, keep notes.

- Close apps, turn off odds alerts.

- Record loss amount, market, trigger, mood.

- Check entry: stake, odds, selection, hedge, match.

- Compare plan versus action, mark rule breaks.

- Lower unit size for next session, cap daily exposure.

- Remove fast deposits, use bank transfer route.

- Return when calm after sleep, meal, walk.

Skip multiples

No lose betting clashes with parlays. Each leg raises variance plus margin, so one slip kills whole ticket. Bookmaker pricing stacks overround across legs, which drags return even when each pick looks sharp. Parlays block hedging, since legs settle at different times and markets shift. Keep singles for offer conversion plus exchange hedges. Exception: tiny fun stake, sized as entertainment spend, never linked to bankroll plan. If you crave higher payout, raise volume through promos, not combined slips at once.

Handle variance

Strategies for sports betting fail when you judge runs, not workflow. Variance means short streaks swing results away from expectation. Two hedged wagers often lose in row, even with sound maths, due to rounding, commission, or void chaos. Measure success by execution: right market, proper stake, matched lay, logged figures, fixed units, plus terms compliance. Use weekly review, not daily emotion. Clean execution deserves continuation under same staking rules. Workflow breaks require pause, repair, then restart with smaller units. Track strike rate, hedge accuracy, and slip errors, then set targets.

Avoid short odds

Low risk football betting strategy avoids short price traps. Such lines offer small upside and high sensitivity to red cards, VAR, plus late goals. Margin bites harder around 1.30, since tiny misprice wipes edge. Think price versus probability. Estimate fair chance, then compare with offered price. Use short prices for promo conversion only when exchange lay price stays close and liquid, so hedge holds. Skip accumulators built from short legs, since one shock ruins ticket. Prefer mid range lines where error margin stays wider overall. Avoid late entry during suspensions or outages.

Stop chasing

Bankroll management plan blocks loss pursuit after losses by locking behaviour to rules. Loss pursuit breaks unit sizing and turns one result into spiral. Set stop loss per day, then lock account tools to enforce it. Use time out after any large hit, then review slips and entry logs before returning safely. Remove fast deposit options from wallet, keep card details off browser, use manual bank transfer. Write plan before session: markets allowed, stake size, max exposure, plus exit rules. Phone away during staking. Tell friend your limits, share totals.

Cashout option with caution

Cash-out value loss hits when bookmakers offer early exit at worse price. Extra margin sits inside quote, cutting EV. Use early exit only when hedge failed, exposure breached limit, or wrong market entry happened. Early exit also helps when settlement delay blocks funds needed for another promo loop. Before clicking, compare offer quote with exchange exit rate, then choose cheaper route. Record time, figure, fee impact, plus reason in tracker. Review cases monthly, then fix causes such as rushed entry or low liquidity. Check terms, since exits void bonuses.

Step-By-Step Zero-Risk Betting Blueprint

Run this plan like a desk routine. Prep first, stake next. Pull one offer. Read rules, copy limits into tracker. Choose liquid match market, compare prices between book and exchange. Enter odds into calculator, set commission, confirm liability fits cap. Place both bets, verify each shows matched. Log details, archive slips. Repeat only after every field matches. Use how to no risk matched betting as workflow, not hunch.

Guard margins by rechecking promo type, expiry, odds floor, market bans, plus cash-out impact. Confirm bonus stake return rule, refund form, plus excluded leagues. Validate selection, match time, market name, plus bet status. If price moves, rerun calculations before any click. Check calculator fields twice, focus lay price plus commission setting. Put odds screen beside tracker sheet, work without distractions, finish one offer before starting another. Record reference numbers for disputes with support teams.

- Withdraw on schedule, reconcile balance.

- Create bankroll pot, separate rent money.

- Pick offer, capture key rules.

- Select event, favour high liquidity.

- Compare book price against exchange lay.

- Input odds, stake, fee, review liability.

- Place first side, hedge within minutes.

- Verify matched status, screenshot slips.

- Update tracker row, attach promo code.

Account Set-Up with Bookmakers & Exchanges

Safe online sports betting starts before first stake. Get KYC ready early, passport or licence plus recent bill. Match details across sites: spelling, address format, mobile number. Choose one payment method in your name. Deposit steady amounts, avoid sudden spikes. Keep bankroll in a separate account, never mix bills. Learn exchange commission rate, then test with small lays on liquid match odds markets. Avoid review triggers: bonus-only wagering, rapid deposits, constant cancellations, plus VPN switching. Keep messages from operators, store statements, keep log tidy.

- Save support chats and statements.

- Scan ID documents, store copies.

- Check email access, set strong passcode.

- Pick one wallet method, confirm name match.

- Enter address once, avoid edits.

- Set deposit limit inside each account.

- Note exchange commission percentage.

- Start with football match odds market.

- Keep stake size small during first week.

- Withdraw modest amounts, keep rhythm.

Stake Calculation with Odds & Liability Tools

A matched betting calculator aligns stakes across book leg plus exchange cover. Add bookmaker price, include fresh current lay quote from ladder. Set back stake, enter commission, read hedge amount, verify exposure stays under cap. Apply rounding, rerun output after price move.

Before clicking confirm, compare market label on book site plus exchange. If liquidity looks thin, switch event, avoid partial fills, spikes.

Common slips: wrong market, unmatched lay, stale quote, swapped fields. Match event, confirm selection, place both sides fast, refresh until full match.

| Field | Meaning | Typical value | Common mistake |

|---|---|---|---|

| Back odds | Book price | 2.04 | Non-decimal entry |

| Back stake | Book amount | £12 | Missing promo cap |

| Lay odds | Exchange price | 2.06 | Wrong runner |

| Commission | Fee rate | 1.8% | Default left |

| Lay stake | Hedge amount | £11.85 | Copying book size |

| Liability | Worst loss | £12.55 | Underfunded wallet |

| Bonus type | Token flag | SNR | Wrong refund form |

| Rounding | Pence tweak | £0.02 | Skipping rerun |

Recording & Tracking Each Wager for Audit

A bet tracking spreadsheet stops silent leaks. Small errors stack: wrong commission, unmatched lays, void on one side, plus missing promo credit. This log gives proof for support, shows true profit, and keeps bankroll honest. Log entry at placement, update after settlement. Store slip screenshots with order view, plus statement line.

Write clean notes, not stories. Flag any mismatch, then fix process next session. Review once per week minimum. Reconcile expected return versus settled figure, then match withdrawals against log rows. Check unmatched orders, confirm fee settings, and scan expiry dates. Keep running balance column, reconcile after each settlement before new deposits. Sort by mistake type, remove weak markets, adjust timing, tighten checklist. If one operator voids often, drop that market type. If slippage repeats, move to calmer kick-off periods.

- Outcome plus notes, capture voids or cash-out.

- Date and time, spot drift spans.

- Operator name, locate statement fast.

- Event plus market, prevent wrong match.

- Selection, avoid runner mix ups.

- Back odds, validate decimal entry.

- Exchange price, confirm ladder level.

- Back stake, keep promo cap safe.

- Hedge amount, balance outcomes.

- Commission rate, estimate net result.

- Liability, enforce exposure ceiling.

- Promo ID, prove qualification.

Essential Tools, Calculators & Software

Tools cut error. They spot price gaps, size hedges, and keep promo rules in view. Start with a small kit. Add extras after volume rises and logs stay clean. In the UK, focus on exchange liquidity, decimal odds, and fee settings. Use no risk matched betting apps once daily offers become routine, since speed helps, yet clean entry protects profit. Treat each signal as the start, then verify every rule and price on screen. Build habits first, then scale.

- Tracker sheet in Excel or Google Sheets: log stake, lay price, fee rate, liability, status.

- Browser profiles: separate bookmakers, keep cookies stable, store screenshots per offer.

- Exchange account dashboard: set commission, view matched orders, check available funds.

- Live odds view plus ladder: confirm depth and spread before entry.

- Rule checklist template: copy limits, expiry, excluded markets, early exit effect.

- Calendar or notifier app: track kick-off times and promo deadlines.

- Advanced suite: offer scanner plus stake assistant, add after stable execution.

Upgrade in stages. Keep tracker as the source, then reconcile balances each week.

Odds Comparison & Surebet Finders

Odds feeds scan markets fast, yet alerts lag. Stale prices, void rules, and stake caps erase an edge in seconds. Treat each alert as a lead. Open the event on both sites, confirm market, start time, and settlement rules. Check exchange depth, then compare the best three prices. Verify max stake and cash-out impact before staking. Save slip screens before and after placement, plus matched view, so disputes stay simple. Use an odds matcher tool with liquid leagues, avoid thin props. Document price and time in tracker, then close tabs.

Matched Betting Calculators & Plug-Ins

Calculators cover three jobs: qualifying stake sizing, free bet conversion, and dutching across outcomes. Plug-ins pull odds from the page to cut typing slips. Set commission to your exchange rate, then check rounding to the penny. Recalculate after any odds move, since drift changes liability. Keep a backup sheet with the same fields for audits during outages. Treat bet calculator usage as routine: confirm market type, confirm selection name, then place bets. For bonus stakes, select token type, stake back rule, plus minimum odds, then rerun figures once more.

Back Lay Calculator

Results:

How to use

Enter your bookmaker back stake and odds. Add the exchange lay odds and your commission rate. Click Calculate. Use the lay stake shown to hedge the same selection on the exchange.

- Use decimal odds, not fractions.

- Check the exchange market matches the bookmaker market.

- Confirm your lay bet is fully matched.

- Recalculate if odds move before placing both sides.

- Record results in your tracker.

How to use

Fill one field only. Click Calculate. The tool converts into all other formats and implied probability.

- Use decimal odds for UK bookmakers.

- Enter American odds as +150 or -200 without symbols.

- Type fractional as 3/2 with a slash.

- Use Reset to clear all fields.

- Record odds format in your tracker for consistency.

Bankroll & Liability Management

Bankroll is working capital. It funds qualifying stakes, covers exchange losses, and keeps you in the game during settlement delays. Liability is the true constraint when you lay, since one win against your lay locks cash at risk. Build float for day to day staking, keep liability reserve for worst case lay outcomes, then set exposure cap so one error cannot wipe the pot. Stability beats fast growth. Match stakes to promo limits, market depth, and your cash on hand. Low risk bets work only when you treat cash as fuel and protect it with rules.

- Set an exposure cap per day, stop when total liability hits it.

- Keep liability reserve untouched, use it only for matched lays.

- Size stakes from bankroll, not from target profit.

- Use fixed unit stakes, raise size only after clean weekly audits.

- Fund exchange wallet before placing, avoid forced exits.

- Skip thin markets, protect against partial matching risk.

- Respect promo caps, avoid stake that breaches terms.

- Withdraw profit on schedule, keep bankroll stable.

Building a Liability Float & Bankroll Allocation

Low risk bet planning splits funds into four pots: float for qualifying stakes, liability reserve for exchange cover, withdrawal buffer for delays, plus a small reserve for fees. Underfunding liability pushes you into cash-out, then mistakes rise fast. Keep caps linked to market depth and commission. Use this model as starting point, then adjust after two weeks of logs.

| Bankroll tier | Reserve % | Qualifying % | Liability % | Buffer % |

|---|---|---|---|---|

| £100 | 10 | 35 | 40 | 15 |

| £200 | 10 | 35 | 40 | 15 |

| £400 | 8 | 32 | 45 | 15 |

| £800 | 8 | 30 | 47 | 15 |

| £1,500 | 6 | 28 | 51 | 15 |

| £3,000 | 6 | 26 | 53 | 15 |

Withdrawal Strategy to Prevent Gubbing

No risk matched betting sites watch patterns. Fast in, fast out, bonus-only play, and repeated hits on soft prices raise flags. Keep behaviour steady. Mix promo work with normal bets inside allowed rules, keep turnover reasonable, and avoid obvious errors in pricing hunts. Withdraw in measured amounts, not after every offer. Let balances sit, then move funds on a set day. Keep promo proof: screenshots, offer IDs, and bet receipts. Stay polite with support, since notes on your account matter. When asked for documents, respond quickly and clearly, then keep messages short.

- Withdraw on set days, avoid instant cash-outs after each bonus.

- Keep stake size consistent, avoid sharp jumps.

- Place some non-promo bets within budget, keep activity normal.

- Skip obvious misprices, focus on standard markets.

- Maintain one payment method, avoid constant switching.

- Keep screenshots of offer terms, stakes, and settlement.

- Use calm support chats, provide facts, avoid arguing.

- Watch for gubbed account signs, then reduce volume and spread activity.

Legal & Ethical Considerations in 2026

UK law permits licensed operators to offer promotions, yet house rules set the playing field. Risk-free betting stays lawful when you use one identity, truthful details, plus funds from your own accounts. Terms often ban multi-accounting, proxy play, syndicate coordination, VPN masking, plus chargeback threats. Breaches bring stake voids, bonus removal, withheld withdrawals, or closure. Read clauses before staking, record promo IDs, store screenshots of eligibility lines, then match stake size to caps. Keep exchange hedges clean, avoid suspicious patterns, keep chat polite, answer requests fast. Keep records for disputes, stay consistent.

UK Gambling Regulation & KYC Rules

KYC checks confirm age, identity, plus funding. Operators flag large deposits, rapid top-ups, sudden stake jumps, or frequent withdrawals. Prepare passport or driving licence, plus utility bill or bank statement dated within 90 days. Keep address format identical across accounts, keep one card or wallet in your name, avoid device swapping during verification. Respond quickly to requests, upload clear images, keep statements ready for source-of-funds review. Affordability reviews ask for payslips, letters, or bank feeds, so keep files organised at home. Keep copies in one folder. If control slips, use limits, time-outs, or GamStop. This reduces sports betting strategy risk.

Tax Position on Betting Profits

UK punters usually pay no tax on winnings from betting, since bookmakers pay duty. Risk free betting profits still deserve records, since bank checks, affordability reviews, or disputes ask for context. Keep statements, bet receipts, promo terms, and exchange history. Edge cases exist where income looks like trade, involves services, or links to sponsorship. In those situations, HMRC rules vary, so check official guidance or speak to a tax adviser. Track net results by month, include fees and commission, and note settlement dates. Store copies offline for long audits. Clear records help you see true performance and keep finances tidy.

Advanced Scaling Tactics

Scaling means tighter workflow, not bigger punts. Add volume only after logs show clean execution across weeks. Build faster screening, strict stake caps, and clear notes. Upgrade tools, then standardise naming, folders, timestamps. Use free zero risk betting strategy for repeat offers, then widen coverage with careful filters. Higher turnover raises restriction pressure plus operational exposure. Strengthen controls first. Add second checks, limit live markets, and stop after one sloppy entry. Extra volume adds admin so keep pace within time.

Multi-Account & Team Play Strategies

Teamwork works when each person runs one lawful profile and stays inside operator rules. Share research, split fixtures, and cross-check odds, yet never share logins, payment cards, or identity files. Prohibited multi-accounting uses one person behind several profiles or uses friends as fronts. Firms treat that as abuse. Outcomes include voided bets, confiscated funds, and permanent closure.

| Fronted profiles | Breaches terms, closure, funds held |

| Shared research | Allowed, separate accounts, separate payments |

| Peer review | Lower error rate, cleaner logs |

For no risk match betting, scale without rule breaks. Divide work. One person tracks promos. Another checks exchange depth. A third verifies calculator inputs before placement. Keep a shared template, yet store slips per person. Run weekly reviews, then cut any book that raises repeated queries. Agree stake bands in advance, then keep amounts steady. Avoid rapid fire bets across many firms on same match. That pattern draws attention. If a bookmaker asks for enhanced checks, pause volume, answer calmly, then resume only after approval in writing. Use separate devices where possible.

In-Play & Cross-Market Arbing

In-play arbing looks clean on screen, yet timing punishes slow clicks. Feeds lag, lines swing fast, and suspension hits without warning. One side settles under one rule set, the other uses different void terms. Exchange fills often arrive partial, leaving exposure during key moments. For betting sports strategy, set controls. Use only top leagues with deep ladders and tight spreads. Place tiny test stakes first, then scale after clean fills. Set a time window of ten seconds, else abort. Check stake caps before entry, then confirm both legs remain live, matched, and priced within your limit. Log each anomaly, capture screenshots, and record order status. Cross-market pairs add traps. A match odds bet often fails to map to draw no bet or lines. Settlement delays differ. If slippage hits twice in one session, stop for the day and review logs.

Common Mistakes & How to Avoid Them

Losses in hedged systems come from mistakes, not match results. Most leakage starts before kick-off. Skipped rule lines, bad market matching, or one wrong figure in a calculator turns a planned edge into red ink. Weak tracking hides the damage until it compounds. Emotion adds fuel. A rushed click after a drift, a late chase, or a hunch bet outside the plan breaks control. Use low risk tips as discipline: read terms, match markets, confirm inputs, verify fills, then log every step.

Gubbing, Stake Limits & Restrictive Practices

No risk gambling still triggers limits when patterns look sharp. Restrictions often start small. You see lower max stakes, slower payouts, missing boosts, or cash-out disabled. Triggers include bonus-only bursts, repeated two-sided prices, fast in and out cashflow, and constant staking on soft lines. Keep behaviour steady. Use varied markets inside terms, keep stake bands stable, and space withdrawals. When limits appear, reduce volume, lower stakes, and focus on offers with wider margins. Keep records for queries, reply fast, stay polite, then rotate operators to protect your pipeline.

| Trigger | Typical sign | Prevention habit | Adjustment step |

|---|---|---|---|

| Bonus-only play | Offers stop appearing | Mix standard bets within rules | Pause promos for a week |

| Fast withdrawals | Payout delay | Withdraw on set days | Leave balance to settle |

| Price pairing pattern | Cash-out removed | Avoid obvious back-lay timing | Use slower markets |

| Hitting soft lines | Lower boosts | Skip extreme misprices | Focus on mainstream leagues |

| Stake jumps | New maximum stake limits | Keep fixed stake bands | Drop to prior band |

| Multiple accounts signals | Extra KYC request | One identity, one payment method | Provide docs, then slow play |

| Rapid bet volume | Manual review messages | Space bets over sessions | Cut daily offers count |

Coping with Market Movement & Slippage

Odds movement timing breaks hedges when prices shift between clicks. The lay drifts, the back shortens, or a market suspends, and the calculator output no longer fits. Control starts with liquidity checks, tight spreads, and a timing rule for placement. Recalculate after any drift and confirm commission settings. Avoid thin props where partial matching leaves exposure. If a hedge fails, stay calm. Screenshot both sides, note times, then hedge the open side at best available price. Log the incident, label the cause, and review patterns weekly. Adjust market choice or timing window.

Try Available Non GamStop Bookmakers

Click the bookmaker name or logo to open the linked review. The review explains the site and shows what to verify.

Sources of information for this article

- UK Gambling Commission, Gambling businesses and consumers

- GamStop, National Online Self-Exclusion Scheme

- Wikipedia, Matched betting

- Reddit, r/matchedbetting

Zero-Risk Betting FAQs

Does no risk matched betting work?

Yes, when you hedge each promo and follow terms. Start with one welcome offer. Use liquid match odds. Log both sides, then reconcile settled returns.

What is the main cause of losses?

Process errors. Wrong market, wrong selection, wrong commission, or missed expiry. Slow down at entry. Verify matched status before leaving the exchange screen.

What sports suit beginners?

Top football leagues and televised fixtures. They bring tight spreads and deep exchange liquidity. Avoid niche props, corners, or cards until logs show clean weeks.

How much starting money helps?

Begin with an amount you accept losing. Hold enough to cover worst case lay liability plus one qualifying stake. Keep bills separate from bankroll funds.

How do I pick a qualifying bet?

Aim for close back and lay prices. Avoid early kick-off markets with high suspension risk. Keep odds above the promo minimum and within stake caps.

What should I do when odds move?

Stop, refresh prices, then rerun the calculator. If the edge disappears, skip the offer. A missed bet beats a forced hedge at a bad price.

What if a lay bet does not match?

Cancel any unmatched amount. Switch to a more liquid market or accept a small loss and close exposure fast. Record the incident for review.

How do I handle refunds and free bets?

Read payout type before staking. Hedge refund offers with care, since rules vary by loss, cash, or token. Log the credit arrival time and expiry.

How do I avoid account limits?

Keep stakes steady. Space withdrawals. Avoid obvious price pairing on every bet. Answer checks quickly with clear documents and calm support messages.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you.

love promos, yet “zero-risk” makes me squint, nothing’s free when terms bite